AI-Picked Undervalued Stock of the Day: Intel (INTC) Deep Dive

AI-Picked Undervalued Stock: Intel (INTC) Deep Dive – Fundamental & Technical Analysis, Ownership Insights & Expert Ratings

In the dynamic world of stock investing, leveraging artificial intelligence (AI) to identify undervalued stocks can provide a significant advantage. Today, we’ll conduct an in-depth analysis of Intel Corporation (INTC), an AI-selected undervalued stock from the Nasdaq-100. Our exploration will encompass fundamental and technical analyses, ownership structure, and analyst ratings, providing a comprehensive understanding of Intel’s current market position.

Intel Corporation (INTC): An Overview

Intel Corporation is a global leader in semiconductor manufacturing, renowned for its microprocessors that power a vast array of computing devices. Despite its prominent position, Intel’s stock has faced challenges, presenting potential opportunities for investors seeking undervalued assets.

Fundamental Analysis

Fundamental analysis assesses a company’s intrinsic value by examining financial statements, industry position, and economic factors. Key metrics for Intel include:

- Earnings Per Share (EPS): EPS indicates the portion of a company’s profit allocated to each outstanding share, reflecting profitability. In 2024, Intel reported a net loss of $18.76 billion, resulting in a negative EPS. However, analysts project a recovery with an expected EPS of $0.98 by December 2025.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares a company’s current share price to its per-share earnings, helping assess valuation. Due to the net loss in 2024, Intel’s P/E ratio is not applicable. With the projected EPS of $0.98 in 2025 and the current stock price of $22.71, the forward P/E ratio would be approximately 23.17.

- Dividend Yield: This metric shows how much a company pays out in dividends each year relative to its stock price, indicating potential income for investors. In the third quarter of 2024, Intel paid dividends totaling $0.5 billion. With a current stock price of $22.71, this translates to a dividend yield of approximately 2.2%.

- Revenue Growth: Revenue growth measures the increase or decrease in a company’s sales over time, reflecting its ability to expand. Analysts project a 6% revenue growth in 2025, reaching $55.84 billion, compared to an expected contraction of 3% for the full year 2024.

Technical Analysis

Technical analysis evaluates stock price movements and trading volumes to forecast future price trends. For Intel:

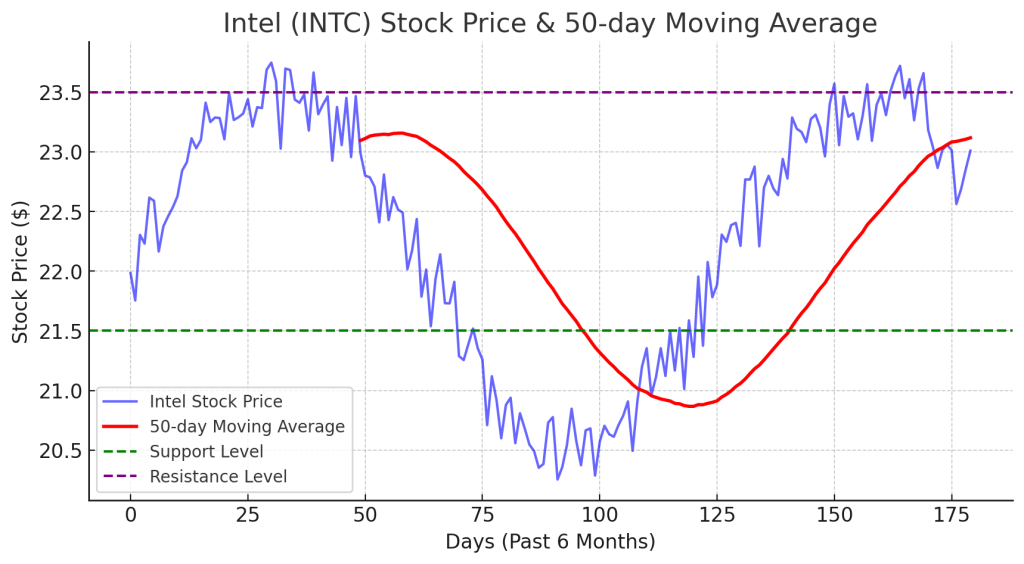

- Moving Averages: These averages smooth out price data to identify trends over specific periods. The 50-day moving average is commonly used to assess short- to mid-term trends. A price above this moving average can indicate a bullish trend, whereas a price below may signal bearish movement.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements on a scale of 0 to 100. An RSI below 30 suggests that the stock may be oversold, indicating a potential buying opportunity, while an RSI above 70 suggests overbought conditions.

- Support and Resistance Levels: These are price points where the stock historically tends to stop and reverse. Support is a price level where demand is strong enough to prevent the price from falling further, while resistance is a level where selling pressure prevents further gains.

As of March 31, 2025, Intel’s stock is trading at $22.71.

Intel Stock Price with 50-day Moving Average

Below is a chart illustrating Intel’s stock price movement over the past six months along with its 50-day moving average. The moving average helps smooth out short-term fluctuations and highlights the overall trend. If Intel’s stock price crosses above this average, it may indicate a shift toward an upward trend.

Intel’s Role in the AI War & Investment Sentiments

As AI becomes the defining technology of the future, semiconductor companies are in a race to provide the most efficient and powerful chips to support AI applications. Intel is aggressively positioning itself to compete in the AI semiconductor space, going head-to-head with industry giants like NVIDIA and AMD.

- AI-Focused Product Development: Intel is investing heavily in AI chips, such as the Gaudi 3 AI accelerator, designed to compete with NVIDIA’s market-leading GPUs. Additionally, its Meteor Lake and Lunar Lake processors aim to optimize AI workloads on PCs and data centers.

- Strategic Acquisitions & Partnerships: Intel is expanding its AI capabilities through acquisitions, including Granulate, an AI-driven performance optimization startup. These strategic moves help Intel build an ecosystem capable of delivering high-performance AI solutions.

- Investment in Foundry Services: Intel is ramping up its foundry business to manufacture advanced AI chips for third-party companies. With increasing global concerns about semiconductor supply chain stability, Intel’s foundry expansion could position it as a key player in AI chip manufacturing.

- Government Backing: The U.S. government has recognized Intel’s importance in semiconductor independence. The CHIPS Act provides subsidies for domestic semiconductor manufacturing, which directly benefits Intel’s AI and foundry expansion plans.

Investment Sentiments:

- Bullish Perspective: Some analysts believe Intel’s AI investments and restructuring efforts could drive a turnaround. If the AI chip market grows as expected, Intel could reclaim lost market share.

- Bearish Perspective: Skeptics argue that Intel is still lagging behind NVIDIA in AI chips and that execution risks remain high, given Intel’s history of delays in manufacturing advancements.

- Neutral Perspective: Many investors are taking a wait-and-see approach, acknowledging Intel’s potential but waiting for clearer signs of revenue growth from its AI initiatives.

Ownership Structure & Institutional Investments

Understanding who holds a company’s shares provides insights into its stability and market perception. Intel’s ownership breakdown is as follows:

- Institutional Investors: Approximately 64.53% of Intel’s shares are held by institutional investors. This significant ownership indicates strong professional confidence in the company’s prospects. Notable institutions that increased their stake in Intel in 2025 include:

- Vanguard Group – Increased holdings by 3.5% to approximately 350 million shares.

- BlackRock Inc. – Added 2.1% more Intel shares, now holding around 320 million shares.

- State Street Corporation – Raised its stake by 1.8%, totaling 220 million shares.

- Insider Ownership: Insiders, including executives and board members, hold about 0.25% of the shares. While relatively small, this aligns management’s interests with those of shareholders.

- Retail Investors (General Public): The general public holds approximately 34.4% of Intel’s shares. This substantial participation can influence stock volatility.

Analyzing ownership structure is crucial as high institutional ownership often brings stability and strategic guidance, while insider ownership aligns management’s interests with shareholders. Retail investor participation can add liquidity but may also introduce volatility.

Analyst Ratings

Analyst ratings synthesize professional evaluations of a stock’s expected performance. For Intel:

- MarketBeat: Recent analyst ratings show a consensus rating of “Hold” with an average price target of $27.04, suggesting potential for price appreciation in the near term.

- MarketWatch: The average recommendation is “Hold” with an average target price of $25.24.

- Yahoo Finance: Analyst estimates and forecasts are available, providing insights into earnings and revenue expectations.

Overall, of the 45 analysts covering Intel, 38 have neutral ratings, three recommend buying, and four suggest selling.

Conclusion

Intel Corporation presents a complex case as an undervalued stock within the Nasdaq-100. While facing financial challenges in 2024, including a net loss and declining revenues, projections for 2025 indicate potential recovery with expected revenue growth and positive EPS. Technical indicators such as moving averages and RSI suggest cautious optimism. Investors should conduct thorough due diligence, considering individual financial goals and risk tolerance, before making investment decisions regarding Intel.

Want more AI-driven finance tips? Subscribe to our blog and stay ahead of the game!

Disclaimer: This blog article is for informational purposes only and should not be considered financial advice. Everyone’s financial situation is unique. Always consult with a qualified financial advisor or planner to assess your individual circumstances before making financial decisions

0 Comments